how to submit sst malaysia

Malaysia Sales Tax 2018. Malaysia Service Tax 2018.

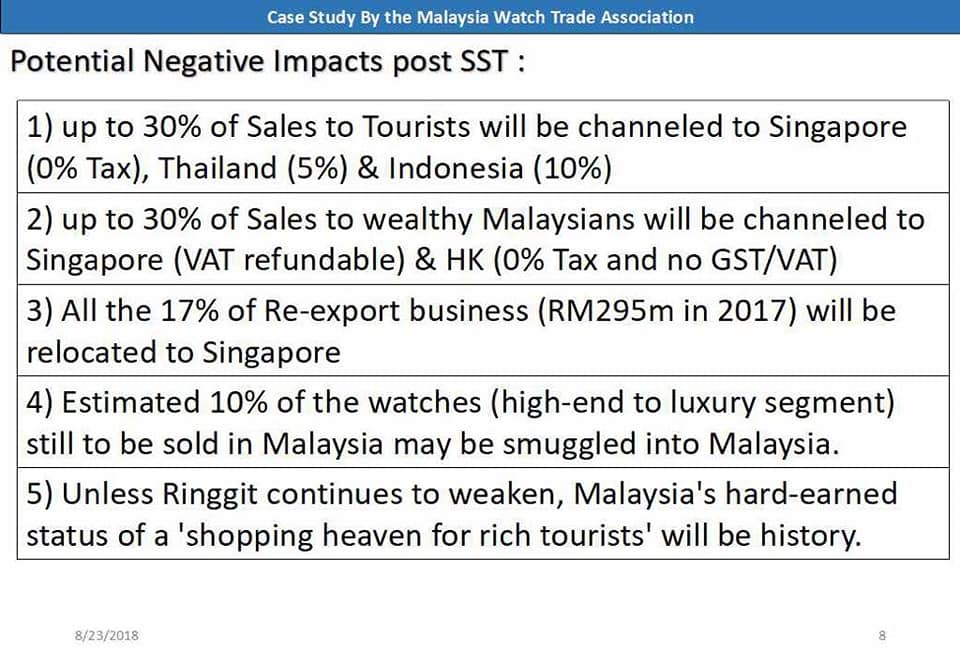

Malaysia Sales And Services Tax Sst Mwta

CVT and eCVT in the Malaysia.

. 2022 proton x70 15 tgdi premium suv - pre reg tanpa sst free sst ready stock high trade in open colour promosi bulan july 2022 promosi merdeka ogos september 2022 proton x70 15. You can choose to withdraw your savings from Account 2 to help finance your own children spouse andor parents education at approved institutions locally or abroad. Ranked at 24 th in 2018 World Banks Ease of Doing Business Malaysia is fast gaining traction as one of the favourite investment destinations to do business in Malaysia and building a business in Malaysia.

When it comes to registering a company in Malaysia there is only one statutory body that all future entrepreneurs will turn to The Companies Commission of Malaysia better known by their local abbreviation of SSM Suruhanjaya Syarikat Malaysia. Be sure to retain your original travel documents ie. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018.

Mid-Term Review of the 11th Malaysian Plan with 45 - 55 GDP Growth Focussing on Sustainable Equitable Economy is Pragmatic. Quality education is the key to a stable career that will result in a comfortable life for you and your family. Honda City 2022 is a 5 Seater Sedan available between a price range of RM 77600 - 108800 in the Malaysia.

Malaysia Airlines Award Travel redemption is subject to the Fare Conditions including SST where applicable and may vary according to the fare class of travel. Monday - Friday 9AM - 6PM PHT English. The Financial Reporting Framework in Malaysia very simply works like this registered companies in Malaysia are all required to prepare statutory financial statements.

Overview of SST in Malaysia. Goods and Person Exempted from Sales Tax. Monday - Friday 9AM - 6PM SST English.

SST Registration in Malaysia. Overview of SST in Malaysia. SST Return Submission and Payment.

Businesses must submit the returns through the online portal of MySST. How to Check SST Registration Status for A Business in Malaysia. How to Check SST Registration Status for A Business in Malaysia.

SST Return Submission and Payment. If your company is already GST-registered the MySST system will automatically register your. All prices indicated inclusive of SST.

Shopping FAQ Returns Cancellations. It is available in 5 colors 5 variants 1 engine and 2 transmissions option. For new accounts the Application for Opening of Account form must be submitted to the stockbroking company where the depositor intends to open the CDS account.

Though the high ranking in the World Banks Ease of Doing Business signifies that starting a business in. And the financial reporting framework serves as a guideline to ensure each criterion that is needed is being fulfilled. How to Calculate SST Malaysia.

This is essential as through this mechanism they can easily provide the essential details. Employers should be aware of the Johor public holiday to better manage business expectations and staffing requirements to ensure a smooth transitional. Replacement device will be provided in the case where the breakage cannot be repaired.

Download free website maker now. The Ministry of Finance MoF announced that Sales and Service Tax SST which administered by the Royal Malaysian Customs Department RMCD will come into effect in Malaysia on 1 September 2018. The City dimensions is 4553 mm L x 1748 mm W x 1467 mm H.

Full payment will be made via Foreign Demand Draft in the currency of your choice If your preferred currency is included in our list of approved currencies. Not applicable for waitlist or open dated tickets. Full payment will be made via Foreign Demand Draft in the currency of the applicants choice.

Monday - Friday 8AM - 5PM MYT English. SST Treatment in Designated Area and Special Area. If your preferred currency is included in our list of approved.

Press the space key then arrow keys to make a selection. SST Treatment in Designated Area and Special Area. Choosing a selection results in a full page refresh.

Find out everything you need to know about SST in Malaysia as a small business owner. Sabah is expected to collect about RM245bil annually from oil royalties as well as state Sales Tax SST payments from the oil and gas sector says Chief Minister Datuk Seri Hajiji. Once you have calculated the amount of sales and service tax you.

This post is also available in. Find out everything you need to know about SST in Malaysia as a small business owner. Goods and Person Exempted from Sales Tax.

Businesses that are exempted from SST must also submit an application for exemption through the MySST website. Submit SST-02 returns and payment. A Complete Guide to Start A Business in Malaysia 2022.

SST Penalties and Offences in Malaysia. Public Holidays in Johor for 2022. Mycareplusco or call 03 9078 4999 to submit a service request 2.

SST Penalties and Offences in Malaysia. Alternatively you may submit the claim via your Enrich account online or you may call the Malaysia Airlines Contact Centre at 1 300 88 3000 within Malaysia and 603 7843 3000 outside Malaysia. Submit a Case Product Security Contact Support Store Support.

East Malaysia Express Delivery Gift Ideas. For other transactions depositors are required to submit the forms to the stockbroking company where the CDS account is maintained. Full payment in Ringgit Malaysia RM will be credited to your account If you hold an active account with our panel bank and your identification number matches the bank records.

Manufacturers Appreciate Reasonable Increase in Minimum Wage Rates. SST Registration in Malaysia. How to make your own free website.

If applicant hold an active account with our panel bank and identification number matches the bank records. Discover more every day. Sales and Service Tax SST in Malaysia.

All Malaysia Airlines Award Travel redemption tickets must be on available and confirmed seat basis at the time of booking. Melayu Malay 简体中文 Chinese Simplified SSM Offices Locations in Malaysia. These dates may be modified if official changes are announced.

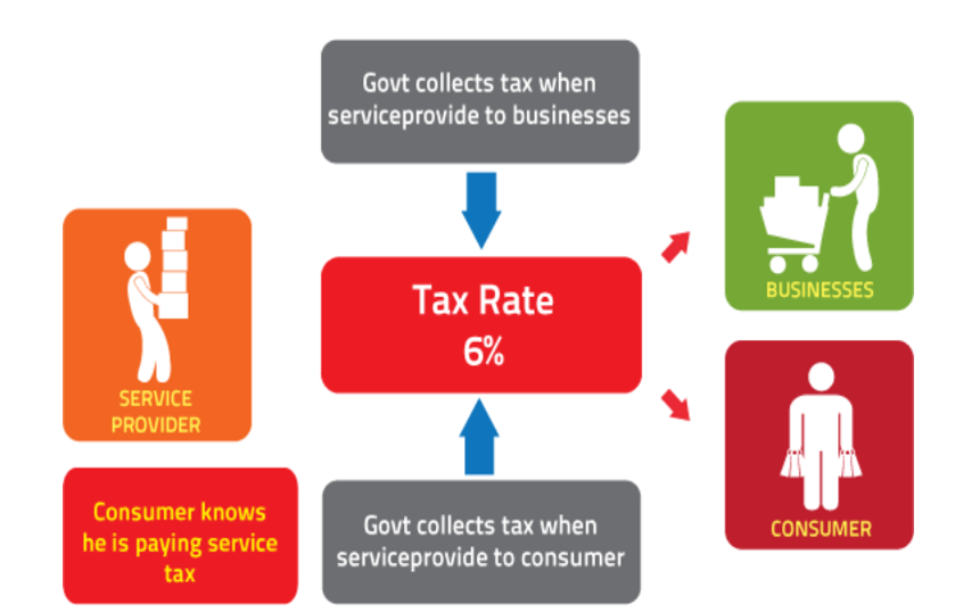

The move of scrapping the 6 GST has paved the way for the re-introduction of SST 20 which will come. News email and search are just the beginning. You can choose to have it picked up from your location or go to any Authorized Service Centers to.

Full payment in Ringgit Malaysia RM will be credited to the applicants. Government Should Refund Outstanding GST Refunds Before Implementing SST. The current tax rate for sales tax is 5 and 10 while the service tax rate is 6.

Boarding pass and ticket stubs as you will need this in order to complete the Missing Enrich. Malaysia Service Tax 2018. Once all the information is provided the system will offer you the payable tax amount.

SST in Malaysia was introduced to replace GST in 2018. Keep adequate records for seven 7 years from the latest. Malaysia Sales Tax 2018.

The Kerajaan Negeri Johor has released the dates of 2022 public holidays happening in Johor Malaysia.

Sst Recording Sst Exemption In Treezsoft Treezsoft Blog

Sst Submission Guide Mysoftcorporation

Top 5 Frequently Asked Questions On The New Malaysia Sst Sales Service Tax Youtube

Malaysia Sales Service Tax Sst Malaysia Sales Service Tax Sst Penang Malaysia Perai Service

Sst2 0 Sst Highlight 20 For Sst Newbie Imposition Facebook

7 Must Knows About Sst Payments For F B Company In Malaysia

Malaysian Service Tax Submission 2018 Mandarin Youtube

All You Need To Know About Sst Malaysia Yh Tan Associates Plt

What Is The Malaysia Sales And Service Tax Sst Answer Single Stage Taxes Levied On Taxable Goods And Services Fastspring

Bro Software Sst Guide Documentation

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Vat Sst Registration In Malaysia 2022 Procedure

Sales And Service Tax Sst Return Submission And Payment

Malaysia Sst Sales And Service Tax A Complete Guide

Product Updates 419 418 And 417 Sst 02 Form Available For Tax Return Submission Malaysian Legislation

%20ENGLISH.jpg)

Comments

Post a Comment